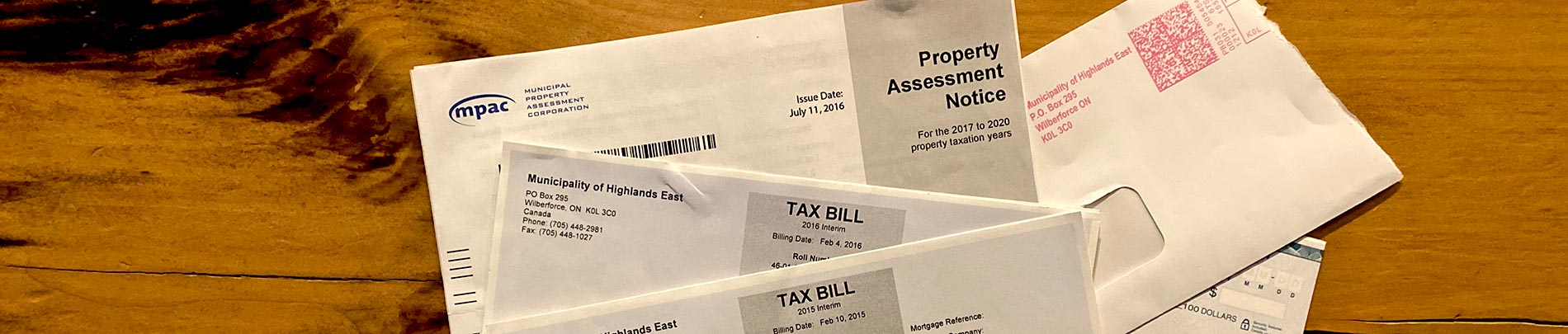

Property Taxes

Property Taxes are due three times per year. The first bill is issued in February and has two instalments that represent 50% of the year's taxes. The due dates are always the last banking day in March and May. The final billing is issued in July and has one instalment that is due the last banking day in September. This final instalment represents the balance of the current year total.

Paying your taxes

We accept payments many different ways, ranging from in-person to online credit card payments. For more details on ways you can pay, visit Paying Your Taxes.

Late payments

Late payments are penalized at the rate of 1.25% per month on the principal amount outstanding.

What to do if you did not get your tax bill

If you did not receive a Tax Bill for the periods mentioned, please contact the Tax Department directly. If needed you can change or update your address.

Tax Statements and Tax Bill Reprints

Tax Statements and Tax Bill Reprints are available at a cost of $10.

Payment can be made in person by cash, cheque or debit; or online via e-transfer or Plastiq. Learn more by visiting our Online Payments page. When paying online please ensure to include your name, property address or roll number, and your email so that your Tax Statement or Tax Bill Reprint can be forwarded to you.

You can email the Tax Department or contact us by phone at 705-448-2981 x424.

Assessments and Tax Rates

The amount of tax you owe is based on the assessed value of your property and the tax rate for the year. You can learn more about property assessments and view our tax rates.

Tax Certificates

Tax Certificates are available at a cost of $75. Please send your request letter by fax at 705-448-1027 or by emailing the Tax Department. You can also contact us by phone at 705-448-2981 x424.

I Want To

I Want To

Subscribe to this Page

Subscribe to this Page