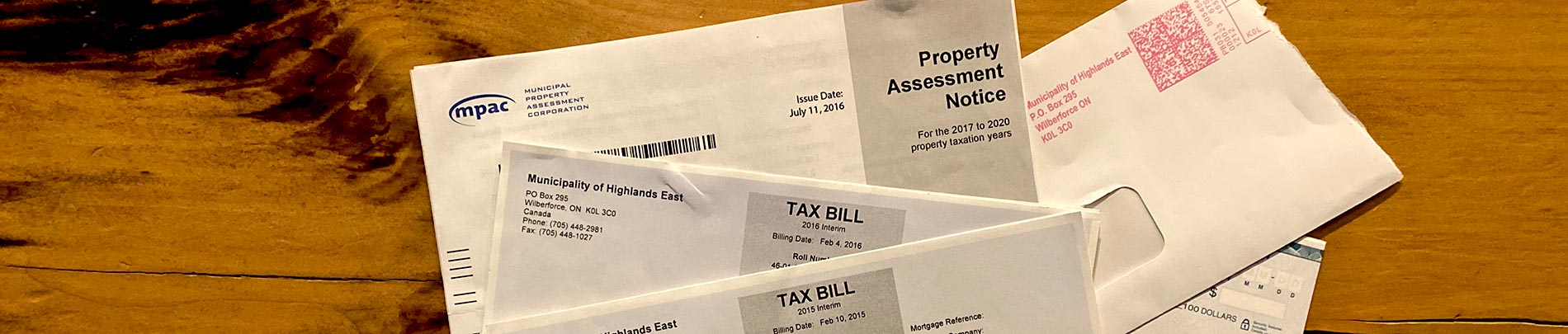

Supplemental Tax Bills

A supplemental tax bill is a bill issued reflecting any additions or improvements made to a property.

Assessment delay

Following an assessment change, the supplementary tax bill will be issued and is effective from the date of occupancy. It can take up to three years for a property to be assessed.

Be prepared

Supplementary billings can occur at any time during the year and taxes for three years could be billed at the same time. For this reason, you are encouraged to start setting aside funds immediately following the issuance of a building permit for the future supplementary tax bills.

Supplemental means extra

A supplemental tax bill is always in addition to the current tax bill already issued. It does not replace a tax bill you have already received.

I Want To

I Want To

Subscribe to this Page

Subscribe to this Page